Purchasing real estate is always a good idea as an acquisition of assets. Miami is a great place for such operations due to many reasons, from the perfect climate to…

Purchasing real estate is always a good idea as an acquisition of assets. Miami is a great place for such operations due to many reasons, from the perfect climate to a wide range of Miami real estate in Florida. However, before you explore the real estate of the city and check Miami real estate listings, you need to study key tips on how to choose great Miami houses to buy.

What You Should Think About

There are a lot of different aspects to account for when you look for a new dwelling. Here are only the most substantive things:

- Estimate your budget for purchasing Miami real estate. Specialists recommend spending on home purchasing not more than 3,5 times of annual income. Follow this advice and calculate the maximum sum you can pay. According to it, search for Miami homes for sale.

- Find your location. Statistics show that millennials prefer southern Miami real estate condos, while mature purchasers choose a house sale in the Miami suburbs on the north. It is also recommended to look at different districts and not concentrate on the city center. You need to focus on infrastructure around your future home (public transport, car parks, shops and malls, social and cultural institutions, and so on), level of safety, and perspectives of the district development.

- Choose a type of dwelling. Propositions of Miami real estate for sale are wide. There are a lot of options of condos and homes. You must think about what is more preferred for you. Essential points you need to account for are the taxes you need to pay, the attractiveness of the dwelling as an asset, your resource to maintain accommodation. If you are not sure that you can afford some housing in the prospect of several years, it is better to select another option.

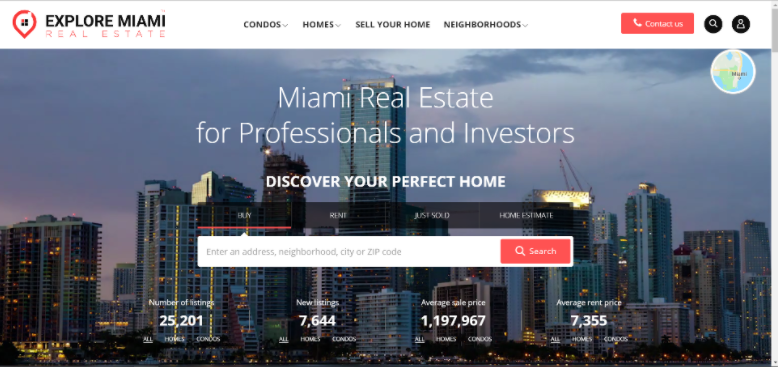

We hope that these three short tips will be useful for you. The last thing you must pay attention to is the trustworthiness of the real estate agency you will cooperate with. If you did not decide until now, the best option is to deal with Explore Miami Real Estate.